Tiffany Aliche has done almost everything imaginable with her money. By 26, she had saved $40,000, more than her annual salary as a teacher. At another point, she accumulated $87,000 in debt. After losing everything in the Great Recession, she took on the scary task of essentially rebuilding her finances from scratch.

For Aliche, the goal was never to become rich. She just wanted to get her finances in order. But sometimes a calling can’t be ignored. When people saw Aliche taking control of her money, they asked for help achieving the same thing. Before she knew it, she was coaching women worldwide on how to save money, buy a home and other topics in her Live Richer Challenge, a series of popular online courses. That’s when she became “The Budgetnista,” a popular podcaster and social media personality.

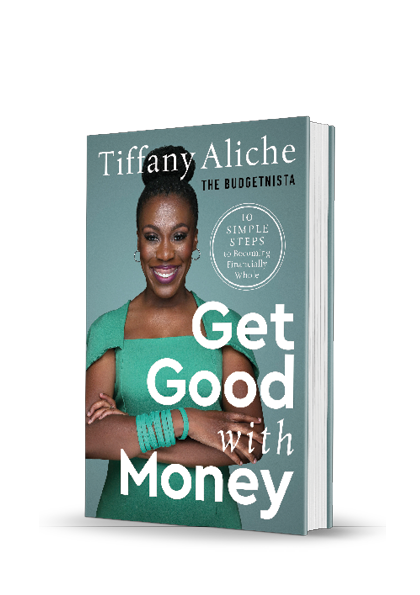

Now that she’s flourishing financially, Aliche is expanding her mission. In her new book, Get Good With Money: Ten Simple Steps to Becoming Financially Whole, Aliche reveals the key to understanding and mastering personal finance—no matter where you are in life.

To learn more about her journey, we asked Aliche what inspired her to write Get Good With Money and what it takes to become financially fierce.

Q: Why did you start your company, The Budgetnista?

My father was a chief financial officer and accountant, so my sisters and I learned about money at home. As a result, I felt very comfortable talking about my finances. I shared the details with college friends, roommates, teachers and parents.

I never thought of it as something I’d do for a living. But when the Great Recession hit, things changed. I lost my teaching job because my school lost its funding. As I was digging myself out of debt, my friends—and friends of friends—asked me to help them with their finances. That’s when The Budgetnista was born. Pretty soon, I started working with different organizations and colleges.

Q: How did you overcome the emotional side of debt to improve your finances?

It was really hard. Money is largely emotional and mental, and I was filled with shame. To overcome that, I had to tell someone about my financial crisis. That person was my best friend, Linda. After hiding the situation from friends and family, I just cried and told her everything. Her response was, “That’s it? Everyone has struggled financially. It’s not that bad. You didn’t steal someone’s puppy.”

The more I talked about my finances, the more empowered I became. I realized that I know how to get out of debt. I know how to budget and save.

That’s one of the reasons I wrote Get Good With Money. So many of us who struggle with our finances, the reason we continue to struggle, quite honestly, is that we hide with shame. People have to find a safe space to share the thing they’re afraid of.

Q: Would you consider this book your greatest work?

I would. This is the culmination of my life’s work because all this time, I’ve been trying to crack the code to money.

People work and get paid, but other than that, what’s next? What do you tell someone who doesn’t know what to do with their money? That’s the question Get Good With Money answers. It’s a step-by-step guide to master the fundamentals of personal finance, including budgeting, saving, debt, credit and learning how to earn. Then it helps you build the rest of your financial house—investing, insurance, net worth, your money team and estate planning. It’s the ultimate guide to reaching what I call financial wholeness.

Q: Some experts focus on financial freedom. Why did you decide to write about financial wholeness instead?

Financial freedom isn’t the answer for most people. Not everyone is going to earn a big pile of money so they don’t have to work anymore. That applies to a small segment of the population, so that’s when I had the “aha” moment. Financial wholeness is for everyone. It’s about making all 10 aspects of your financial life work together for your biggest benefit.

Q: How did your background as a teacher help you write this book?

I taught preschoolers, so I learned to instruct from a place of empathy. Financial education can seem scary, similar to when a 3- or 4-year-old starts preschool. So in this book, right away, I knew how to allay readers’ fears. I used my superpowers as a teacher to make sure people didn’t feel afraid, alone, or judged.

Q: Salaries and personal debt aren’t widely discussed. How did it feel to open up and share your money problems?

By now, I’m used to talking about what once made me feel ashamed. I like sharing those things because if I can make all these mistakes and still become financially whole, so can others. I know a lot of people will think that’s easy for me to say. But I’ve made all the major money mistakes—foreclosure, falling for credit card scams, high student loan debt. I’ve lost everything and had to rebuild from scratch. So I actually like to share those lessons and teach from a place of empathy and understanding.

Q: In your book, you say there’s no such thing as a small financial choice. How did you come to that conclusion?

It happened when I was 9 or 10. That’s when I made my first conscious money decision. My birthday was coming up, and instead of getting the purple Barbie bike I wanted, I chose a big, blue bike. It was so big that I got to ride it through middle school and high school. Thirty years later, that purchase is still relevant. The bike is in my parent’s garage, and my dad rode it for exercise just a few years back.

Everyone has a blue bike they’re dragging around with them, good or bad. Is it your choice to pay for every streaming platform? To never learn how to style your hair? Those money decisions seem small, but like my blue bike, they follow you for the rest of your life. All of your choices matter, and they accumulate.

Q: Do you still have financial goals you’re working toward?

Of course! That’s the benefit of financial wholeness. It’s not a one-and-done solution. I’ll give you an example. When I was 27, I had a $300,000 insurance policy and a $220,000 condo. If something happened to me, that policy would have covered my mortgage and my debt. But 41-year-old Tiffany? I’ve got a stepdaughter, a husband, nieces and nephews. I also have some businesses. My insurance policy needs to be in the seven-figure range to cover everything.

I’m financially whole today. But as I get older, financial wholeness will begin to look different for me.

Q: Do you have plans for your next book?

I always feel like you should write when you have something to say. If I feel like there’s a part two, then certainly, I will lean into it. Maybe I’ll dive deeper into some of the sections in Get Good With Money. Or maybe I’ll write a book about business. It depends on the value I can add to other people.

Q: What do you want readers to take away from this book?

Financial wholeness is for everyone. Even if you never become a millionaire, you can still get good with your money. You can have a great financial life filled with peace, security and abundance.

This article originally appeared in the May/June 2021 issue of SUCCESS magazine.

Featured Image by © Tinnetta Bell

Photos courtesy of Tiffany Aliche