Whether you realize it or not, you are constantly telling stories in your own head. Self-stories: Stories you tell about yourself. Some are good, some are bad. All of them have a powerful effect on you, even if you’re unaware of them.

As a storytelling expert, I believe that you can change the story of your life by changing the voice in your head, that changing the way you are on the inside can change your results on the outside.

Some of the most obvious examples I have come across in research and interviews are the stories we tell ourselves about money. Our shared belief in the value of money is one of the oldest, most powerful and arguably most important stories in human history. But money isn’t just the ultimate story. It’s also the most heavily loaded story.

You’ve heard stories about money your whole life. You’ve accepted that “money doesn’t grow on trees,” or that “money is the root of all evil,” or that “a light purse is a heavy curse.” Maybe you have warned your insistent teenager through clenched teeth that you, in fact, are not made of money or that “all that glitters is not gold.”

Regardless of the words you use, by now you can see these sentences for what they are: iceberg statements pointing to the enormous, hidden money story beneath the surface of our awareness. And those examples are only the universal statements. The personalized versions are far more varied and even more powerful:

“I am bad with money.”

“I’ll never be rich.”

“I can’t afford nice things.”

“Money is scarce.”

“Money’s not my thing.”

“I like to live for the moment, not save for a rainy day.”

“I need a job with a steady paycheck.”

“I always struggle to pay my bills.”

When it comes to money stories, there is no shortage. Yet, for all their abundance, like most of the stories we tell ourselves about ourselves, our money stories often remain undetected and allowed to run rampant through our lives.

The 4 Money Stories You Should Evaluate

Most, if not all, of us have anxious moments concerning money. No matter what our income, we all have some variation on four basic money stories.

1. How much you have

I have a friend who is a saver. I don’t mean she is able to tuck a little aside for a rainy day. I mean she has seven figures in a savings account. Although many people would find a deep sense of financial security in that level of wealth, my friend agonizes over it. She tells herself she should invest it, that inflation is eating away at it, that she’s missing out on a chance to grow her wealth in any meaningful way. And so she walks around constantly afraid of her own money.

For my friend, taking a look at this particular aspect of her money might reveal stories from her childhood—what her parents valued. There are probably some stories in there about liquidity. Some stories in there about using money to make more money. About the “right” way to “do” money. It is highly likely that these stories are so big they keep her frozen in place. Instead of calling a financial adviser or calling a real estate agent who specializes in investment properties, she does nothing, and therefore, nothing changes.

Keep in mind that because money is just a really big story, it is also entirely relative. Someone who secured the first salaried position in their family’s history at $25,000 could see their story as just as good or better than the story of somebody who makes $250,000 but whose friends make millions. If you’re struggling with money, examining the stories that fuel your understanding of how much you have is an important place to start.

2. How much you need

I have another friend who, from the outside, appears to have everything professionally. He has a good job, he makes a good salary and is good at the work he does. But there’s a lot about the job he doesn’t love. He feels he has so much capacity that will never be recognized at the company.

The question is, then, why doesn’t he leave? He has explored other options, but every time he talks with a company that values his big-idea capabilities, it’s a startup with limited funds. He would have to take a pay cut to leave his big corporate job.

The next logical question anyone might ask is: Would it be worth it? Sure, it’s less pay, but it’s also less agony and potentially more joy and fulfillment. The answer, for him, is no. He needs more money. Why? Because he earns less than his dad.

Now, I won’t go into the depths of his story with his father. That’s not my story to tell, and, to be honest, I’m not entirely sure he realizes it’s there. But the thing for you to understand is that it’s a money story. The roots of his behavior are buried deep in a story that really has nothing to do with how much money he needs to run his life. It’s a story about the money he needs to feel worthy.

How much is enough? And if you have what you need, then why are you anxious?

3. Where money comes from

I was talking to a man whose work situation is in flux. He is faced with the prospect of having to move to a new city to keep his job. He doesn’t want to. He’s happy where he is. He has a home, a life.

“But,” he says, “I can’t leave the job. The money’s too good. I’ll never make that money anywhere else.”

His belief is that the money he’s accustomed to can only come from one source: his current job. But where does his money really come from? Is it from the company he works for, or does it come from his experience and ability? Is it from outside or inside?

4. How money should be used

Imagine two people. Their financial situation, for the purpose of this example, is identical. They have the same amount of debt, the same amount of income and the same set of standard expenses

Person A decides to hire someone to come and clean their home on a weekly basis. It costs $100 a week. Person A’s logic is that this frees up a significant amount of their time that used to be spent on cleaning but can instead now be spent on other things—work, exercise or free time with the family.

Person B has heard that Person A hired someone to clean their house once a week but has no interest in doing so. Person B is perfectly capable of keeping the house tidy on their own and, in fact, enjoys doing so. Person B would much rather keep that $100 than spend it on something they can do for free.

Both people feel they’re using their money wisely, and they both think they’re saving money, but which one of them is right?

They both are, provided their stories serve them.

This is a big one. This is the one that can come between friends and tear apart marriages.

The only way to keep these stories from stomping through your life like Godzilla in a fit of fiery destruction is to analyze them—to take a good look below the surface and figure out where the stories come from and why they are there.

Money stories are some of the most difficult to pin down, but you can dig into them with the same questions you use to analyze any story:

Where did this story come from?

- Is this story true?

- Why is the story there?

- What price do I pay for this story?

- Does this story serve me?

- Where am I in this story?

When it comes to money stories, it’s important to approach this part of the process with a sense of curiosity rather than from a place of judgment. Seek to understand. There’s no “right” money story. There are only stories—some of which serve you and some of which don’t.

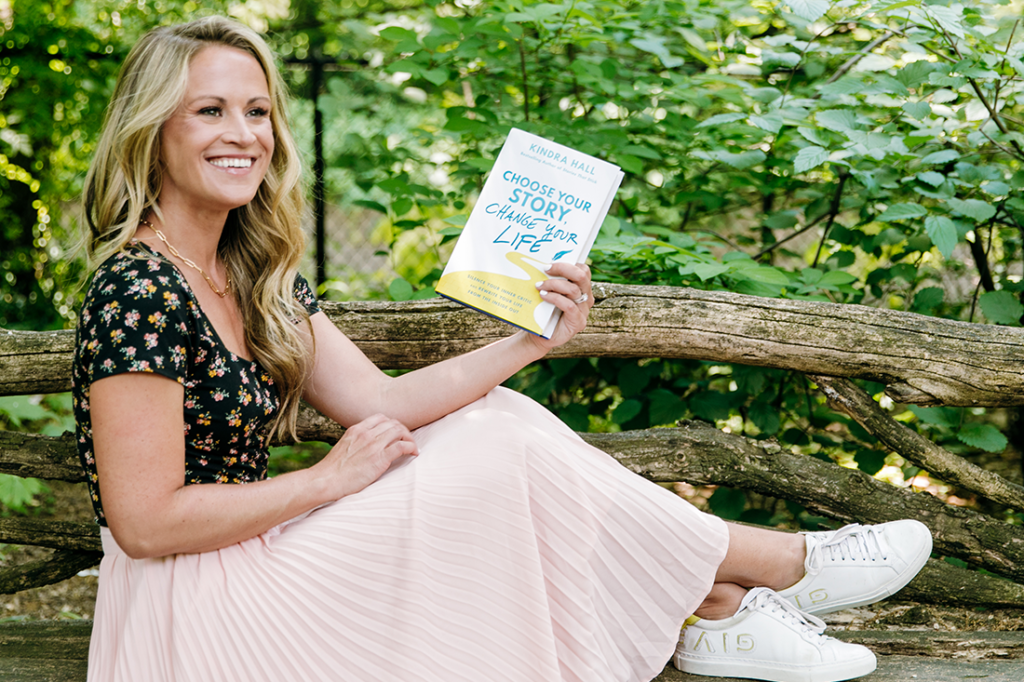

Taken from Choose Your Story, Change Your Life by Kindra Hall. Copyright ©2022 by Kindra Hall. Used by permission of HarperCollins Leadership. www.harpercollinsleadership.com.

This article originally appeared in the January/February 2022 Issue of SUCCESS magazine. Photo by ©Kara Nixon Photography