Culture & Workplace

27 Micro-Actions That Build Workplace Culture (Weekly Framework)

Entrepreneurship

101 Profitable Business Ideas for Women Entrepreneurs in 2026

Business & Branding

How to Build a Personal Brand That Grows Your Business in 2026

Current Issues

MARCH / APRIL 2026

THE INTELLIGENCE ISSUE

Featuring: Mayim Bialik

SCIENTIST, ACTOR AND PODCASTER DRIVING WELLNESS FORWARD

Buy the Latest Issue

JANUARY 2026

THE GUIDE TO REINVENTION

Featuring: Amy Porterfield

THE MULTIMILLION-DOLLAR PIVOT: THE ART OF SCALING BACK TO SCALE UP

Read Free on SUCCESS Labs™Never Miss an Issue

Subscribe NowCategories

Explore What Drives Success

From AI-powered strategies to wealth-building fundamentals, leadership insights to entrepreneurial fire — dive into the topics that matter most to your growth.

AI & Technology

View All →Business & Branding

View All →

Business & Branding

How to Build a Personal Brand That Grows Your Business in 2026

Business & Branding

Brand Success Factors: What Makes Companies Win in 2026

Longevity & Performance

View All →

Longevity & Performance

Avoid the DST Hangover: Daylight Saving Time Hacks 2026

Longevity & Performance

The Dopamine Trap—the Rarely Discussed Source of Burnout Developers Face in an AI Age

Longevity & Performance

Why a Sleep Retreat Could Be the Most Strategic Move a Leader Can Make

Professional Growth

View All →

Professional Growth

How to Change Careers at 30, 40 or 50: A Step-by-Step Guide

Professional Growth

Career Tips for Young Professionals That Earn Respect

Professional Growth

How to Network With LinkedIn ‘Coffee Chats’ in 2026

The SUCCESS Store

Invest in Your Next Level

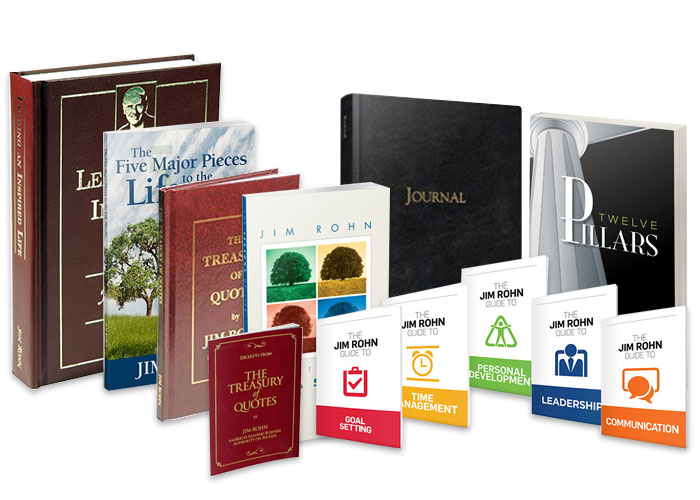

Jim Rohn Book Bundle

The complete Jim Rohn collection — timeless wisdom on success, wealth, and personal development.

$97.00$181.69

The Jim Rohn Guides Complete Set

The full collection of Jim Rohn's practical guides on goal setting, communication, and leadership.

$18.71

The Five Major Pieces to the Life Puzzle

Jim Rohn breaks down the five key areas that determine your quality of life.

$24.99

Culture & Workplace

View All →

Culture & Workplace

27 Micro-Actions That Build Workplace Culture (Weekly Framework)

Culture & Workplace

A Remote Team Became 40% More Engaged With This Meeting Tool

Culture & Workplace

How to Build Trust in a Remote Team (Tips & Team-Building Exercises)

Entrepreneurship

View All →

Entrepreneurship

101 Profitable Business Ideas for Women Entrepreneurs in 2026

Entrepreneurship

The 2026 Founders’ Guide to Salaries

Entrepreneurship

How AI Influencers Generate Millions Per Year

Trends & Insights

View All →

Trends & Insights

Success News: Top Business Trends and Insights

Trends & Insights

Are AI Tools Changing How Our Brains Process Information?

Trends & Insights

Google Searches for ‘AI-Proof Jobs’ Skyrocket

World-class keynote speakers for your next event, summit, or conference.

Anne Grady

Author

Jen Gottlieb

Branding

Trent Shelton

Branding

Stay Connected

Get weekly insights on leadership, growth, and the future of work delivered to your inbox.

Subscribe to the Newsletter